Ikhtisar platform ICO Coinolix

Is that COINOLIX?

COINOLIX is a multifunctional cryptocurrency exchange platform with a powerful ecosystem and decentralized blockchain protocol by providing various crypto currencies, especially ERC20 tokens. Cooinolix exchange follows best practices by storing most assets in cold storage, which are not on a web server or other computer to secure funds users in the exchange wallet so members don’t worry about their assets.

And now there are two types of exchange systems that are already running, which are based on pure currency exchange and cryptocurrency-based exchanges. Coinolix will only focus on exchanging pure cryptocurrency. Currency exchange from pure cryptocurrency with world-class trading facilities in exchange for Coinoix, where Token holders can use CLX tokens to pay for almost all types of fees including trading fees, withdrawal fees, registration fees.

The Coinolix exchange platform aims to give users a quick and safe way to trade their erc20 tokens. Therefore, Coinolix will design the architecture of the trade framework from the initial stage with its main priority being security, effectiveness, speed and adaptability as pure cryptocurrency exchanges. , Coinolix will also provide cross platform Device Coverage:

Coinolix features

Matching Machine The

number of high trade requests can be offset by machines that can adapt and expand in a few moments.

number of high trade requests can be offset by machines that can adapt and expand in a few moments.

User interface

We will provide cross platform device coverage on all browser based trading platforms, Android and iOS device platforms, PC trading platforms (Windows, mac, linux), REST API.

We will provide cross platform device coverage on all browser based trading platforms, Android and iOS device platforms, PC trading platforms (Windows, mac, linux), REST API.

Features

Exchange services exclude Spot market trading, Margin trading, Futures trading market.

Exchange services exclude Spot market trading, Margin trading, Futures trading market.

Assets to

Ditukar Coinolix Exchange will support trading partner in BTC, ETH, XRP, LTC, DASH, NEO (ANS), CNC (Coinolix Coin), USDC (Coinbergix coins set by the USD)

Ditukar Coinolix Exchange will support trading partner in BTC, ETH, XRP, LTC, DASH, NEO (ANS), CNC (Coinolix Coin), USDC (Coinbergix coins set by the USD)

24/7

Support and responsibility for customer support to be distributed within our staff and company in such a way that customer-specific issues can be resolved by the designated officer for the particular problem.

Support and responsibility for customer support to be distributed within our staff and company in such a way that customer-specific issues can be resolved by the designated officer for the particular problem.

Security

protection DDoS attacks exchange Audit Two-factor authentication and encryption Proposal

protection DDoS attacks exchange Audit Two-factor authentication and encryption Proposal

Current Market Players

Binance

Binance has a daily trading volume of 225 billion USD. it’s not regulated and not company info on the website. Exchange stops taking registration in January 2018 due to scaling issues on the website and going down for more than 24 hours in February.

Binance has a daily trading volume of 225 billion USD. it’s not regulated and not company info on the website. Exchange stops taking registration in January 2018 due to scaling issues on the website and going down for more than 24 hours in February.

Bittrex

Bittrex has a daily trading volume of around 500 million USD. it is regulated by the New York bitcoin license and registered in the US. Bittrex also slows down customer responses and waits for ticket scenarios. Bittrex stopped taking new customer applications from December 2017.

Bittrex has a daily trading volume of around 500 million USD. it is regulated by the New York bitcoin license and registered in the US. Bittrex also slows down customer responses and waits for ticket scenarios. Bittrex stopped taking new customer applications from December 2017.

Poloniex

Poloniex has a daily trading volume of around 140 million USD. it is registered and regulated in Boston, MA, USA. These exchanges provide exchange, margin and loan facilities to users and margin trading sometimes ends with forced trading and liquidation, when all or part of your position is closed. This exchange also has a slow reputation for customer response

Poloniex has a daily trading volume of around 140 million USD. it is registered and regulated in Boston, MA, USA. These exchanges provide exchange, margin and loan facilities to users and margin trading sometimes ends with forced trading and liquidation, when all or part of your position is closed. This exchange also has a slow reputation for customer response

Bitfinex

Bitfinex has a daily trading volume of around 180 billion USD. it is registered and non-regulated exchange based in Hong Kong. Bitfinex was also a victim of hacking in 2016 which resulted in 75 million losing its users’ funds and is currently being

investigated by the United States government.

Bitfinex has a daily trading volume of around 180 billion USD. it is registered and non-regulated exchange based in Hong Kong. Bitfinex was also a victim of hacking in 2016 which resulted in 75 million losing its users’ funds and is currently being

investigated by the United States government.

Problem

Architecture

The trade framework must be designed starting from the earliest stage with security, effectiveness, speed and adaptability as top priority. Many exchanges often choose the easiest way to handle to get the framework and running. Although this can work wonderfully to get started with, when activities develop, the framework will not be ready to handle the expanded network load. This often supports the progress of exchange, but this is the basis for long-term achievement.

The trade framework must be designed starting from the earliest stage with security, effectiveness, speed and adaptability as top priority. Many exchanges often choose the easiest way to handle to get the framework and running. Although this can work wonderfully to get started with, when activities develop, the framework will not be ready to handle the expanded network load. This often supports the progress of exchange, but this is the basis for long-term achievement.

Liquidity

Because crypto business is very new, it is not right in liquidity. Having a bad order book implies high slippage when trading cryptocurrency, which is very expensive for traders.

Because crypto business is very new, it is not right in liquidity. Having a bad order book implies high slippage when trading cryptocurrency, which is very expensive for traders.

Platform Security

Almost all cryptocurrency cannot be changed and there is no way to change after the transaction is made because this exchange refuses to be responsible for the transaction. There are several exchanges that have dropped because of

hacking.

Almost all cryptocurrency cannot be changed and there is no way to change after the transaction is made because this exchange refuses to be responsible for the transaction. There are several exchanges that have dropped because of

hacking.

There is an exchange-driven progress that will benefit by respecting the acknowledged hack. However, this progress is expensive to the point that exchanges do not have the opportunity to get

into them, which means they are responsible for almost all programmers with sufficient knowledge. how to overcome their security framework.

into them, which means they are responsible for almost all programmers with sufficient knowledge. how to overcome their security framework.

Poor customer support

Traders are different types of users. Understanding user problems is very important for running successful exchanges. At the point when the exchange demonstration in a way that undermines the merchant’s trust will be unacceptable, resulting in a tone of user complaints.

Traders are different types of users. Understanding user problems is very important for running successful exchanges. At the point when the exchange demonstration in a way that undermines the merchant’s trust will be unacceptable, resulting in a tone of user complaints.

Language Support

The Cryptocurrency market has no limits, Most exchanges concentrate only on one dialect or one country and this results in poor support for this international market.

The Cryptocurrency market has no limits, Most exchanges concentrate only on one dialect or one country and this results in poor support for this international market.

Banking barriers

Banks also hinder unlimited trading elections from the exchange, due to volatile foreign exchange market conditions. The bank places itself behind the foot when it comes to verification and background checks of users.

Banks also hinder unlimited trading elections from the exchange, due to volatile foreign exchange market conditions. The bank places itself behind the foot when it comes to verification and background checks of users.

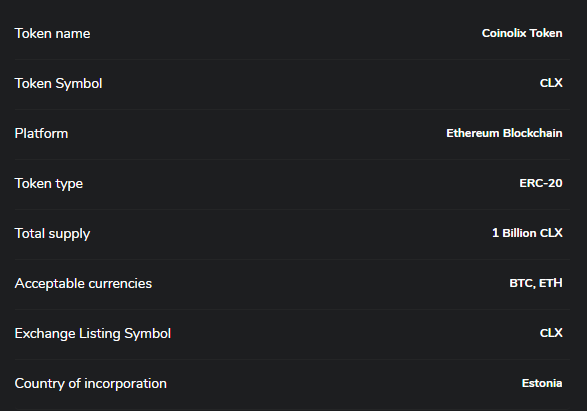

CLX Token Detail

CLX Tokens are ERC20 standard tokens from the Ethereum Blockchain. This multipurpose token can be used as a medium of exchange and to pay transaction fees, trading fees, withdrawal fees, listing fees on Coinolix Exchange.

Token Coinolix

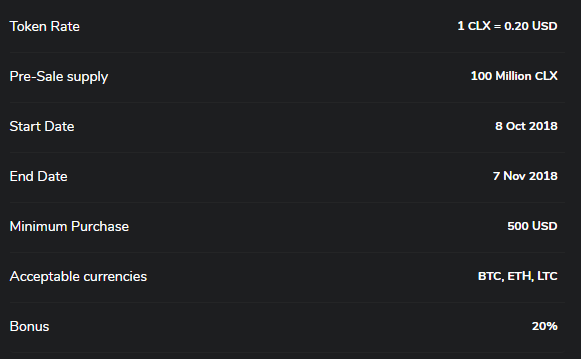

Pre-sale details

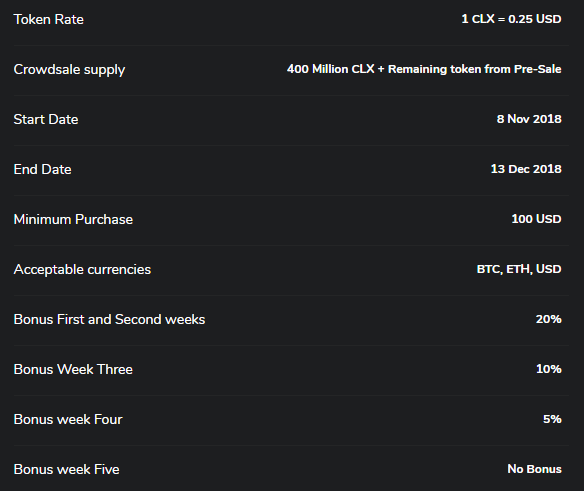

Detail crowdsale ICO

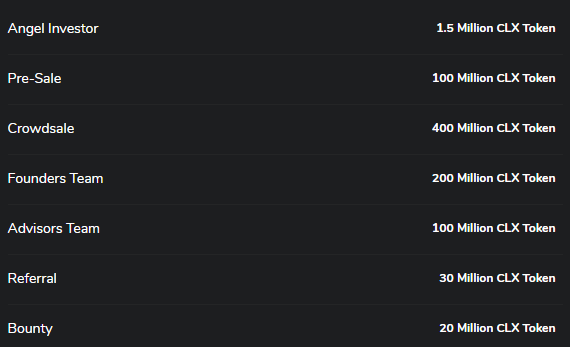

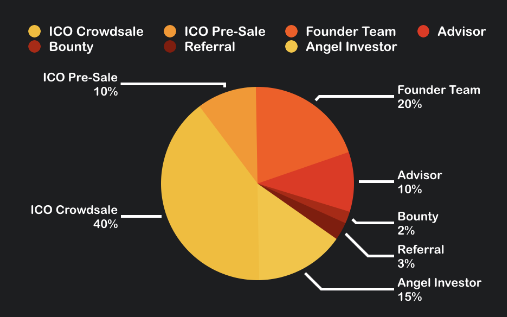

Token Distribution

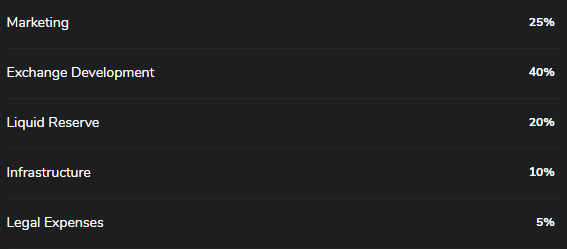

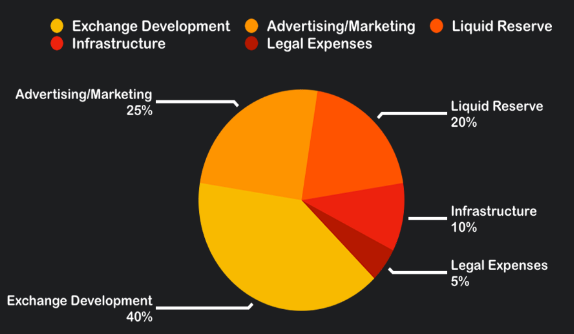

Details of funds usage

Roadmap

Project Team

FOR MORE INFORMATION YOU CAN VISIT SOME OF THE FOLLOWING LINK:

Tidak ada komentar:

Posting Komentar